Carving the Pathway to Prosperity: Unravel the Ideal Low-Tax Destinations Tailored for the Affluent, Offering Unrivaled Safety, Growth, and Financial Peace of Mind

– No Borders Founder Guide

Introduction: The Voyage Towards Destiny

Picture yourself aboard a grand vessel, its sails unfurling as the winds of change guide you across the vast seas of global finance. This ship is your wealth, and the compass you hold is this article, pointing you towards the safe havens of 2023—destinations where prosperity and peace coexist, nurtured by low taxation.

The world of finance is an ever-changing, intricate ocean. But with the right knowledge, resources, and a reliable crew by your side, the journey becomes an adventure of self-discovery, empowerment, and growth. So, let us set sail towards the pillars of global stability and explore the tax benefits that these destinations offer to the high net worth individuals.

Switzerland: The Alpine Stronghold of Wealth

Switzerland, the fortress amidst the Alps, stands strong and steady against the tempests of the global economy. Famous for its unrivaled political stability, uncompromising privacy laws, and an enticing tax system, it becomes a beacon for the elite, seeking a safe house for their wealth.

Switzerland’s cantonal tax system is akin to a gift that keeps giving. While the rates may vary by canton, the system, on the whole, fosters wealth accumulation. The country’s repertoire of double taxation treaties with various nations forms a robust defense mechanism that safeguards your wealth.

Switzerland’s all-encompassing banking ecosystem, the accommodating regulations, and the proximity to major European markets make it an irresistible destination for those looking to anchor their assets securely.

Singapore: The Lion City of Financial Empowerment

Emerging from the heart of Asia, Singapore is a testament to a perfect blend of East and West. The Lion City boasts a robust economy, unwavering political stability, world-class infrastructure, and a rich cultural heritage. With its strategic geographical location, it has become a central hub for global business, attracting the world’s elite.

Singapore’s corporate tax rates hover around a mere 17%. But what truly makes it a crown jewel is its relentless commitment to innovation. Singapore offers various tax incentives and exemptions for startups and industries breaking new ground, thereby fostering an environment that promotes wealth growth and security.

Luxembourg: The Golden Nugget of Europe

Luxembourg, though compact in size, is a titan in the world of finance. Situated in the heart of Europe, it’s an international hub for banking, finance, and investment funds. Luxembourg combines the stability of European politics, the strength of a high-performing economy, and the attractiveness of an intricate tax structure into a golden nugget of opportunity.

Luxembourg’s corporate tax rate stands at 24.94%—a reasonable offer in the global scheme of things. But the real treasure lies in its extensive network of double taxation treaties and special tax regimes for specific types of companies. For high net worth individuals seeking tax-efficient structures, Luxembourg is akin to a secret vault full of golden opportunities.

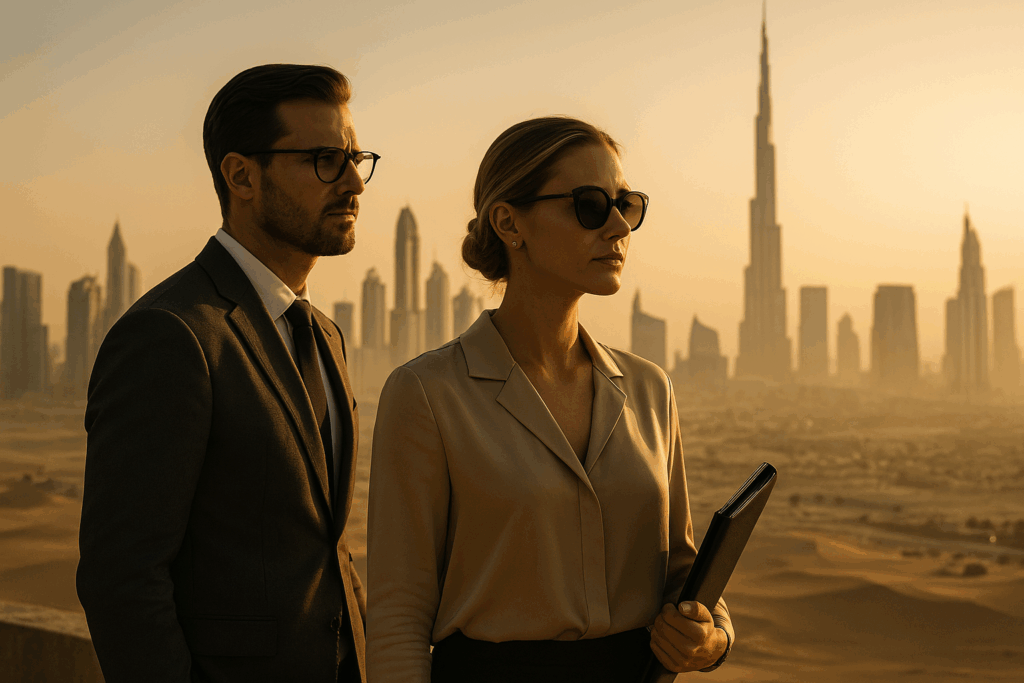

United Arab Emirates: The Oasis of Infinite Possibilities

Sprouting like a mesmerizing mirage in the Arabian Desert, the United Arab Emirates (UAE) is a magnetic blend of rich cultural heritage and dynamic economic growth. The cities of Dubai and Abu Dhabi, like two magnificent jewels in the crown of the UAE, are global magnets for businesses and affluent individuals.

The allure of the UAE lies in its captivating tax policy. With no income tax on individuals or corporations, it becomes an oasis of wealth preservation. The UAE’s free zones, each offering a tailored blend of special tax, customs, and import rules, amplify its appeal. As a result, it morphs into a tax-free sanctuary where wealth growth knows no bounds.

Cayman Islands: The Caribbean Sanctuary of Prosperity

The Cayman Islands, nestled in the Caribbean’s azure waters, are more than just an idyllic tropical paradise. These islands have morphed into a global financial hub, providing an amalgamation of modern infrastructure, political stability, and sophisticated financial services to the global elite.

The distinctive appeal of the Cayman Islands lies in its zero-tax regime—no income tax, wealth tax, capital gains tax, or corporate tax burden the residents. This fiscal liberty, paired with stringent privacy regulations and robust asset protection legislation, positions the Cayman Islands as a compelling destination for wealth protection and exponential growth.

Conclusion: Setting Sail with No Borders Founder

The journey to uncover your perfect financial haven is akin to a seasoned explorer seeking treasure—it presents challenges, but the rewards are worth every ounce of effort. Switzerland, Singapore, Luxembourg, the United Arab Emirates, and the Cayman Islands each offer a unique blend of safety and low taxation, but each individual’s financial landscape is different and requires a tailored approach.

Are you ready to set sail on your journey of financial discovery? At No Borders Founder, we are your steadfast crew, guiding your ship through the tumultuous waves of global finance. Our treasure troves of experience and wisdom are at your disposal, ensuring your financial legacy weathers every storm.

Together, we will plot a course towards your financial destiny—the haven that perfectly aligns with your wealth aspirations. The world is your oyster, and your destiny awaits. Let us guide you to it. Your adventure starts here.

FAQs: Charting Your Course to Financial Destiny in the Safest Low-Tax Havens for High Net Worth Individuals

- What are the safest low-tax countries for high net worth individuals in 2023?

Guiding high net worth individuals towards their financial destiny, countries like Switzerland, Singapore, Luxembourg, the United Arab Emirates, and the Cayman Islands stand out as the safest low-tax countries in 2023. - How can moving to a low-tax country impact my financial destiny?

Residing in a low-tax country can significantly shape your financial destiny by allowing you to preserve and grow your wealth more efficiently. - How does No Borders Founder assist in shaping my financial destiny?

No Borders Founder aids in charting your financial destiny by providing insights and guidance on the best low-tax and safe countries for high net worth individuals. - Why are Switzerland and Singapore attractive destinations for shaping my financial destiny?

Switzerland and Singapore have robust economies, stable political environments, and favorable tax regimes, making them ideal for high net worth individuals aiming to enhance their financial destiny. - What role does taxation play in shaping my financial destiny?

The level of taxation significantly influences your financial destiny, as lower taxes can lead to more substantial wealth accumulation over time. - How does the United Arab Emirates fit into my journey towards financial destiny?

With zero income tax and numerous free zones, the UAE is a significant stopover in your journey towards financial destiny, offering unmatched opportunities for wealth growth. - Can residing in the Cayman Islands positively impact my financial destiny?

Yes, the Cayman Islands, with its zero-tax regime and robust privacy regulations, can steer your financial destiny towards greater wealth protection and growth. - What factors should I consider when choosing a country for better financial destiny?

Factors like tax rates, political and economic stability, privacy laws, and lifestyle should be considered when choosing a country for your ideal financial destiny. - How does Luxembourg’s tax structure influence my financial destiny?

Luxembourg’s tax structure, complete with double taxation treaties and special tax regimes, can significantly sway your financial destiny towards more tax-efficient wealth management. - Is moving to a low-tax country the only way to secure my financial destiny?

While moving to a low-tax country can be beneficial, your financial destiny can also be secured through sound investments, diverse income streams, and efficient wealth management strategies.#FinancialDestiny #HighNetWorthIndividuals #LowTaxHavens #WealthManagement #Switzerland #Singapore #Luxembourg #UAE #CaymanIslands #NoBordersFounder