Exploring the Unique World of Income Tax-Free Countries and Understanding their Economic Impact

Embrace Financial Freedom and Optimize Your Tax Burden by Exploring Income Tax-Free Countries Worldwide

Introduction: A Tale of Freedom: Income Tax-Free Countries

Imagine this for a moment. You’re a business owner or a high-net-worth individual seeking financial freedom and the ability to maximize your wealth. Every year, you diligently pay your fair share of income tax, watching a substantial portion of your hard-earned money being depleted. The relentless cycle of taxation can often feel burdensome and restrictive, hindering your ability to fully enjoy the fruits of your labor. But what if there was a way to escape this never-ending financial drain? What if there were countries where income tax was non-existent, allowing you to enjoy the benefits of tax-free living?

Welcome to the captivating world of income tax-free countries, where financial liberation and the preservation of wealth are paramount. In this comprehensive guide, we will embark on a journey of exploration, shedding light on the concept of tax havens, providing a detailed and up-to-date list of income tax-free countries in 2023, delving into the economic perspectives of choosing such nations, uncovering the potential pitfalls, and introducing you to No Borders Founder, a trusted solution that can guide you on the path to tax-free living and help you seize the numerous benefits available to businesses, high-net-worth individuals, and families.

The Concept of Tax Havens Explained

Tax havens, also known as fiscal paradises, are jurisdictions that offer favorable tax conditions to foreign investors, often featuring low or zero “effective” rates of taxation. These countries or territories create an environment where certain taxes, particularly income tax, are levied at a minimal or non-existent rate. The allure of tax havens lies in their ability to attract individuals and businesses seeking to optimize their tax burden, protect their assets, and ultimately enjoy financial freedom.

The concept of tax havens has been the subject of much debate and scrutiny over the years. While some view them as havens for tax evasion and illicit financial activities, others argue that they play a legitimate role in international finance, attracting investment, promoting economic growth, and fostering healthy competition among nations. It’s important to note that not all tax havens are created equal, and many jurisdictions have taken steps to ensure transparency, compliance with international standards, and cooperation in combating financial crimes.

Income Tax-Free Countries in 2023: The Complete List

As of 2023, several countries worldwide have chosen to abolish income tax, positioning themselves as havens for global citizens and businesses looking to harness the benefits of tax-free living. Here is a comprehensive list of income tax-free countries in 2023:

- Bahamas: The Bahamas, a tropical paradise in the Caribbean, offers individuals and businesses the advantage of no income tax, capital gains tax, or corporate tax. The country’s economy thrives on tourism, offshore banking, and international financial services.

- Monaco: Nestled on the French Riviera, Monaco is renowned for its luxurious lifestyle and zero income tax policy. It attracts high-net-worth individuals from around the world, offering them a glamorous tax-efficient haven.

- Andorra: Situated in the Pyrenees mountains between France and Spain, Andorra offers a serene environment and favorable tax conditions. The country imposes no income tax, capital gains tax, or inheritance tax, making it an appealing option for individuals and businesses seeking tax optimization.

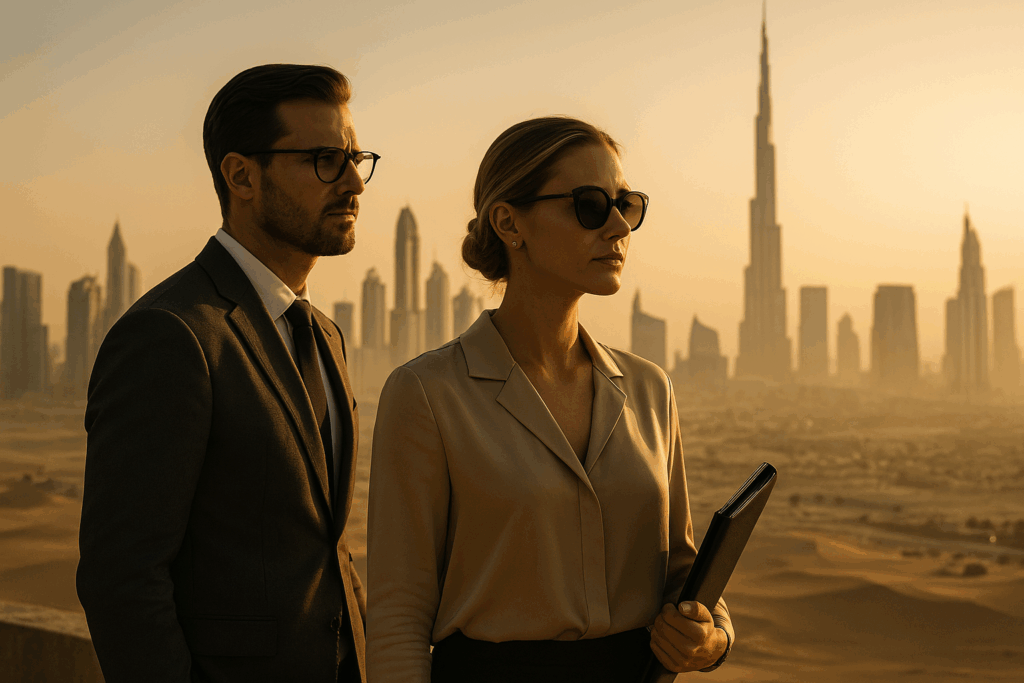

- United Arab Emirates (UAE): The UAE, particularly Dubai and Abu Dhabi, has emerged as a prominent business hub in the Middle East. While the UAE does not impose income tax on individuals, corporate tax obligations may exist for businesses operating in certain sectors. The country’s economy is diverse, with sectors such as finance, real estate, tourism, and logistics driving its growth.

- Bermuda: Located in the North Atlantic Ocean, Bermuda offers a tax-efficient environment with no income tax, capital gains tax, or corporate tax. The country’s economy revolves around offshore financial services, insurance, and tourism.

- Cayman Islands: A cluster of tropical islands in the Caribbean, the Cayman Islands are synonymous with picturesque beaches, crystal-clear waters, and a favorable tax environment. With no income tax, capital gains tax, or corporate tax, the Cayman Islands have established themselves as a premier destination for offshore banking, investment funds, and international business.

- Saint Kitts and Nevis: This twin-island nation in the Caribbean offers a unique path to tax-free living through its citizenship-by-investment program. By making a qualifying investment, individuals and their families can become citizens and enjoy the benefits of tax-free living. Saint Kitts and Nevis do not levy income tax on worldwide income, making it an attractive destination for high-net-worth individuals and investors.

- British Virgin Islands: The British Virgin Islands (BVI) is a renowned jurisdiction for offshore companies and investment vehicles. It imposes no income tax, capital gains tax, or corporate tax, making it an appealing choice for individuals and businesses seeking tax optimization. The BVI’s economy relies on offshore financial services, tourism, and real estate.

- Oman: Situated in the Arabian Peninsula, Oman offers individuals a tax-efficient oasis with no income tax. However, corporate tax obligations may exist for businesses operating in certain sectors. Oman’s economy is driven by oil and gas exports, tourism, and logistics.

- Qatar: In the heart of the Arabian Gulf, Qatar shines as an economic powerhouse with no income tax for individuals. Qatar’s diversified economy, encompassing sectors such as natural gas, finance, and real estate, makes it an attractive destination for tax-efficient living.

While these countries waive income tax, it’s crucial to note that they may still have other types of taxes in place, such as Value Added Tax (VAT), customs duties, or specific industry-related taxes. Consulting with tax professionals and understanding the broader tax landscape is essential for individuals and businesses considering these jurisdictions.

Each income tax-free country has its own unique advantages, requirements, and considerations. Understanding the local regulations, residency or citizenship requirements, business opportunities, and quality of life factors is essential to make an informed decision about which country aligns best with your goals and aspirations.

Why Choose a Tax-Free Country: Economic Perspectives

Choosing to live or establish a business in an income tax-free country offers numerous economic advantages. By eliminating or significantly reducing the burden of income tax, individuals and businesses can retain a more substantial portion of their earnings. This increased liquidity can be channeled towards investments, wealth accumulation, or even enhancing one’s quality of life.

Moreover, tax-free countries often attract foreign direct investment, leading to economic growth, job creation, and increased opportunities for businesses and entrepreneurs. The absence of income tax provides businesses with the opportunity to reinvest profits and allocate resources towards expansion, innovation, and talent acquisition. It fosters a business-friendly environment that encourages entrepreneurship and rewards enterprise.

Additionally, income tax-free countries tend to have robust financial systems, political stability, and well-developed infrastructure, making them attractive for companies seeking a favorable business ecosystem. Access to international markets, favorable corporate tax rates, and streamlined business regulations further enhance the appeal of tax-free countries as business havens.

The Pitfalls of Tax-Free Nations: The Other Side of the Coin

While income tax-free countries offer undeniable advantages, it’s important to consider the potential pitfalls and challenges associated with them. These pitfalls may vary from country to country and could include higher costs of living, limited access to certain markets or resources, stringent immigration policies, or the potential presence of other taxes to compensate for the absence of income tax.

In some cases, the reliance on alternative revenue streams, such as indirect taxes or fees, may result in a higher overall tax burden or increased costs for certain goods and services. It’s crucial for individuals and businesses considering tax-free countries to conduct thorough research, evaluate their specific needs and goals, and seek professional advice to make informed decisions.

Striking the right balance between tax optimization, lifestyle preferences, and long-term financial goals is crucial when considering income tax-free countries. It requires careful consideration of the local business landscape, legal and regulatory frameworks, and the overall cost of living.

What It Means for Businesses: Income Tax-Free Countries as Business Havens

For businesses of all sizes, income tax-free countries can serve as alluring business havens, offering a range of benefits. These countries provide an environment conducive to growth, innovation, and profit maximization. By eliminating the burden of income tax, businesses can retain more earnings and allocate them strategically, whether it’s towards research and development, marketing efforts, or expanding operations.

Furthermore, tax-free countries often boast favorable corporate tax rates, streamlined business regulations, access to international markets, and an array of financial incentives. These factors combine to create a business-friendly ecosystem that can attract both local and international companies, fostering competition, collaboration, and economic prosperity.

No Borders Founder: Your Gateway to Tax-Free Living

No Borders Founder understands the aspirations of business owners, high-net-worth individuals, and families who seek to embrace tax-free living and unlock the benefits it offers. As a trusted and experienced partner, No Borders Founder can guide you through the intricate process of establishing a presence in an income tax-free country, ensuring compliance with legal and regulatory frameworks, and optimizing your tax structure.

No Borders Founder provides tailored solutions based on your specific needs and objectives, offering a range of services, including:

- Tax Planning: Developing personalized strategies to minimize your tax liabilities while maintaining compliance with local tax regulations.

- Company Formation: Assisting with the establishment of companies and legal entities in income tax-free countries, ensuring efficient and compliant corporate structures.

- Residency and Citizenship: Advising on residency and citizenship options in tax-free countries, facilitating the process of relocation and ensuring a smooth transition.

- Asset Protection: Implementing measures to safeguard your assets, preserve wealth, and mitigate risks associated with taxation and legal complexities.

- Banking and Financial Services: Facilitating access to reputable banking and financial institutions, enabling seamless financial operations and wealth management.

- Compliance and Reporting: Ensuring adherence to local tax regulations, reporting requirements, and ongoing compliance to maintain your tax-free status.

No Borders Founder combines extensive expertise, a global network of professionals, and a deep understanding of the intricacies of income tax-free countries. They empower you to make informed decisions, navigate the complexities of tax optimization, and seize the opportunities presented by tax-free living.

How No Borders Founder Can Help You Achieve Tax-Free Living

With No Borders Founder as your trusted partner, you can embark on a journey towards tax-free living with confidence and peace of mind. Here’s how No Borders Founder can assist you:

- Tailored Guidance: No Borders Founder will assess your unique circumstances, goals, and preferences to develop a customized plan that aligns with your vision of tax-free living.

- In-Depth Research: They will conduct extensive research on income tax-free countries, evaluating various factors such as tax regulations, business environment, quality of life, and residency requirements to identify the most suitable jurisdictions for your needs.

- Comprehensive Support: No Borders Founder will guide you through every step of the process, from company formation and residency acquisition to tax planning and compliance, ensuring a smooth and efficient transition to tax-free living.

- Expert Network: Leveraging their vast network of professionals, including lawyers, accountants, and relocation specialists, No Borders Founder will provide access to top-tier expertise in international tax law, corporate structuring, and immigration matters.

- Ongoing Assistance: No Borders Founder offers ongoing support, keeping you updated on regulatory changes, assisting with compliance obligations, and providing strategic advice to optimize your tax-free lifestyle.

No Borders Founder is committed to empowering individuals and businesses with the knowledge, tools, and support required to embrace tax-free living. By leveraging their expertise and guidance, you can navigate the complexities of international taxation, unlock the potential of income tax-free countries, and enjoy the numerous benefits they offer.

Embracing Financial Liberation Through Income Tax-Free Countries

As we venture further into 2023 and beyond, the allure of income tax-free countries continues to captivate the minds of business owners, high-net-worth individuals, and families seeking financial liberation and tax benefits. These countries present a unique opportunity to retain a larger portion of your hard-earned income, optimize your tax burden, and enjoy the freedom to allocate resources towards wealth creation, investments, and personal fulfillment.

However, it’s crucial to approach tax-free living with a comprehensive understanding of the benefits, challenges, and obligations associated with such jurisdictions. Thorough research, expert advice, and strategic planning are paramount to ensure a successful transition and long-term compliance.

With No Borders Founder as your dedicated partner, you can navigate the complexities of tax-free living with ease, leveraging their expertise, network, and comprehensive solutions to achieve your financial goals. Embrace the potential of income tax-free countries and embark on a journey of financial liberation and prosperity.

Embrace the promise of tax-free living and unlock the path to financial liberation. The world of income tax-free countries awaits, offering a gateway to wealth preservation, growth, and the realization of your financial aspirations. Let No Borders Founder be your guiding light on this remarkable journey.

Frequently Asked Questions (FAQ) – Income Tax-Free Countries

What are income tax-free countries?

Income tax-free countries are jurisdictions that impose little to no income tax on individuals and businesses, allowing them to retain a larger portion of their earnings.

Why would I consider relocating to an income tax-free country?

Relocating to an income tax-free country can offer significant tax benefits, allowing you to optimize your tax burden and retain more of your hard-earned money for wealth creation and personal fulfillment.

How can income tax-free countries benefit businesses?

Income tax-free countries provide businesses with the opportunity to maximize profits, reinvest earnings, and operate in a business-friendly environment that fosters growth, innovation, and international collaboration.

Are income tax-free countries legal?

Yes, income tax-free countries are legal. While they have faced scrutiny in the past, many jurisdictions have implemented measures to ensure transparency and compliance with international tax regulations.

What other taxes should I be aware of in income tax-free countries?

While income tax may be non-existent, income tax-free countries may have other taxes such as Value Added Tax (VAT), customs duties, or industry-specific taxes. It’s important to understand the complete tax landscape of each jurisdiction.

How can No Borders Founder help me in exploring income tax-free countries?

No Borders Founder is an expert advisory firm specializing in tax planning, company formation, and residency services. They can guide you through the process of exploring and establishing a presence in income tax-free countries, ensuring compliance and maximizing tax benefits.

Can I maintain my citizenship while living in an income tax-free country?

Yes, in most cases, you can maintain your citizenship while living in an income tax-free country. However, residency or citizenship requirements may vary depending on the jurisdiction.

Are there any risks associated with living in income tax-free countries?

While income tax-free countries offer numerous advantages, it’s important to consider factors such as the cost of living, limited access to certain resources, and potential changes in tax regulations.

How do I determine which income tax-free country is best for me?

Choosing the right income tax-free country depends on various factors such as your financial goals, lifestyle preferences, business requirements, and residency or citizenship considerations. No Borders Founder can provide personalized guidance to help you make an informed decision.

Can I benefit from income tax-free countries if I operate an online business?

Yes, income tax-free countries can be advantageous for online businesses as well. Many of these jurisdictions have well-established digital infrastructures and favorable business environments for e-commerce and online enterprises.

What are the residency requirements in income tax-free countries?

Residency requirements vary from country to country. Some may require a minimum physical presence, while others offer residency or citizenship programs through investment options. No Borders Founder can assist in navigating these requirements.

Can I access international markets from income tax-free countries?

Many income tax-free countries have strategic geographic locations and well-connected transportation networks, providing businesses with access to international markets and facilitating global trade.

How can No Borders Founder assist me in establishing residency in an income tax-free country?

No Borders Founder has a team of experts who can guide you through the residency application process, including assisting with paperwork, providing guidance on investment options, and ensuring compliance with local regulations.

Will I still be subject to tax obligations in my home country if I move to an income tax-free country?

Tax obligations in your home country may still apply, depending on your individual circumstances and the tax laws of your home jurisdiction. Consulting with a tax professional is advised to understand your specific tax obligations.

Can No Borders Founder assist with ongoing compliance in income tax-free countries?

Yes, No Borders Founder offers ongoing support and can assist with compliance requirements in income tax-free countries, ensuring that you adhere to local tax regulations and reporting obligations.

Remember, it’s important to consult with tax professionals and legal experts to understand the specific tax regulations, residency requirements, and legal obligations associated with income tax-free countries. No Borders Founder is dedicated to providing expert guidance and support throughout your journey to tax-free living.

Unshackle Your Finances and Embrace Financial Liberation with No Borders Founder

Are you tired of watching your hard-earned money vanish into the clutches of high taxes? Are you ready to break free from the chains of financial burden and unlock the secrets to tax-free living? Look no further than No Borders Founder – your ticket to an audacious journey towards true financial liberation.

No more sacrificing your wealth at the altar of excessive taxation. With No Borders Founder by your side, you can navigate the treacherous waters of income tax-free countries and seize the advantages that await you. Our team of experts will guide you through the murky depths of tax planning, company formation, and residency acquisition, empowering you to reclaim what is rightfully yours – your money and your freedom.

Imagine a life where your earnings are shielded from the clutches of greedy tax authorities. Picture yourself in the lap of luxury, basking in the glory of tax-free living, while others remain bound by the chains of exorbitant taxes. No Borders Founder is here to disrupt the status quo and empower you to take control of your financial destiny.

But beware, this journey is not for the faint of heart. It requires audacity, determination, and a burning desire for financial sovereignty. We are the renegades of the tax world, challenging the norms and charting a new course towards a future where your wealth is yours to keep.

So, are you ready to liberate your finances from the clutches of income tax? Are you ready to join the ranks of the enlightened few who dare to defy the status quo? Embrace the audacity, embrace the freedom, and let No Borders Founder be your guiding light on this radical voyage towards tax-free living.

Take the first step towards reclaiming your financial freedom. Unleash your potential with No Borders Founder today. Your destiny awaits – unshackle your finances and embrace the audacious path to true financial liberation.

#IncomeTaxFreeCountries #TaxOptimization #FinancialFreedom #TaxFreeLiving #TaxHavens #BusinessHavens #NoIncomeTax #TaxPlanning #TaxEfficiency #WealthPreservation #InternationalTax #GlobalTaxStrategy #TaxCompliance #OffshoreBusiness #ResidencyPlanning #CitizenshipByInvestment #TaxAdvisory #NoBordersFounder #TaxFreeWealth #MaximizeProfits